QuickBooks Self-Employed Review: Our Verdict

QuickBooks Self-Employed is an excellent choice for you if you run a business as a sole proprietor, entrepreneur, freelancer, solopreneur, or independent contractor due to its ease of use, automatic mileage tracking, and unique bookkeeping support. It excels at simplifying your tax tracking and separating business and personal expenses.

However, it falls short when serving your expanding business, needs more double-entry accounting, and is more expensive than some competitors. Despite these limitations, its features, including quarterly tax estimates and seamless integration with other apps, make it a strong option if you are self-employed and looking for a straightforward accounting solution.

Pros

- Calculates your quarterly tax estimates.

- Integrates with popular business apps like PayPal and Square.

- Offers a user-friendly interface, making it straightforward to manage your finances.

- Categorizes business expenses easily and assigns each one to Schedule C categories.

- Tracks your business-related mileage automatically, which is handy for tax deductions.

- Provides affordable personalized bookkeeping support, with options to choose plans that include live tax support.

Cons

- Tends to be more expensive than top competitors like Wave Accounting

- Has features specifically for freelancers and solopreneurs, it does not meet entirely the needs of rapidly expanding businesses.

- Lacks support for double-entry accounting. Unlike some other accounting tools, this limitation is a drawback if you need more robust financial tracking

>>> MORE: Billing Software: How to Choose

1. QuickBooks Self-Employed Review: Who QuickBooks Self-Employed Is Best For

QuickBooks Self-Employed is a great fit for you if you:

- Are a freelancer, independent contractor, or sole proprietor

- Value personalized support, with plans offering live tax support from tax experts

- Seek an easy-to-use platform to manage your finances without complex features.

- Need to track income, expenses, and mileage for tax purposes, with automatic mileage tracking

2. QuickBooks Self-Employed Review: Who QuickBooks Self-Employed Is Not Right For

QuickBooks Self-Employed is not suitable for you if you:

- Run a growing business and need more advanced features.

- Need advanced reporting for detailed financial analytics.

- Require double-entry accounting, as this software lacks that functionality.

3. QuickBooks Self-Employed Review: What QuickBooks Self-Employed Offers

Record Income and Expenses

Using QuickBooks Self-Employed, tracking your business’s income and expenses is simple. This feature helps you keep track of your financial transactions, making tax time less stressful.

Tracking Miles Automatically

QuickBooks Self-Employed automatically tracks your business-related mileage. It’s especially useful if you drive for work purposes. QuickBooks Self-Employed detects when you’re on the move and records the distance you travel.

Distinguish Personal and Business Expenses

QuickBooks Self-Employed allows you to categorize your expenses as either business or personal. This separation simplifies tax deductions, ensuring you claim only the relevant expenses.

Identify and Monitor Growth Objectives

Define your business goals, whether it’s increasing revenue, expanding your client base, or achieving a specific profit margin. QuickBooks Self-Employed lets you monitor your progress toward these goals.

Personalize Bills and Estimates

Create professional estimates for potential clients and invoices for complete work. You can customize these documents with your branding and relevant details.

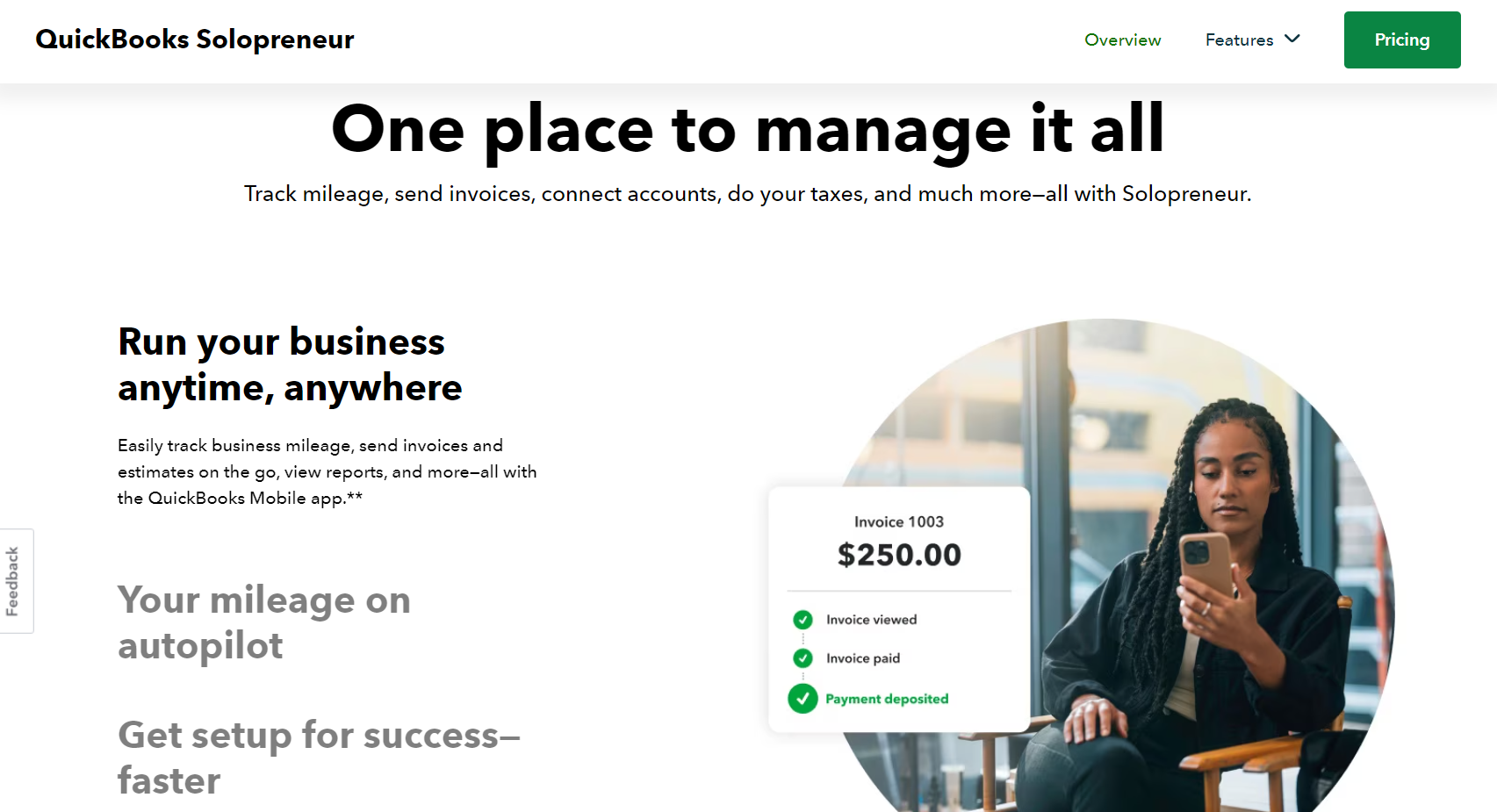

Mobile Application

Manage your business finances on the go using the mobile app. You can record expenses, track mileage, and view your financial data from your smartphone or tablet.

Receive Payments

QuickBooks Self-Employed allows you to receive payments from clients directly through it. You can connect your bank account or use other payment methods.

Integration of Bank Accounts for Businesses

Link your business bank account to QuickBooks Self-Employed. This integration streamlines expense tracking and ensures accurate financial records.

Professional Tax Assistance

If you need assistance with tax preparation, it provides access to experts who can guide you through the process.

>>> PRO TIPS: Best Accounting Software for Online Retailers

4. QuickBooks Self-Employed Review: QuickBooks Self-Employed Details

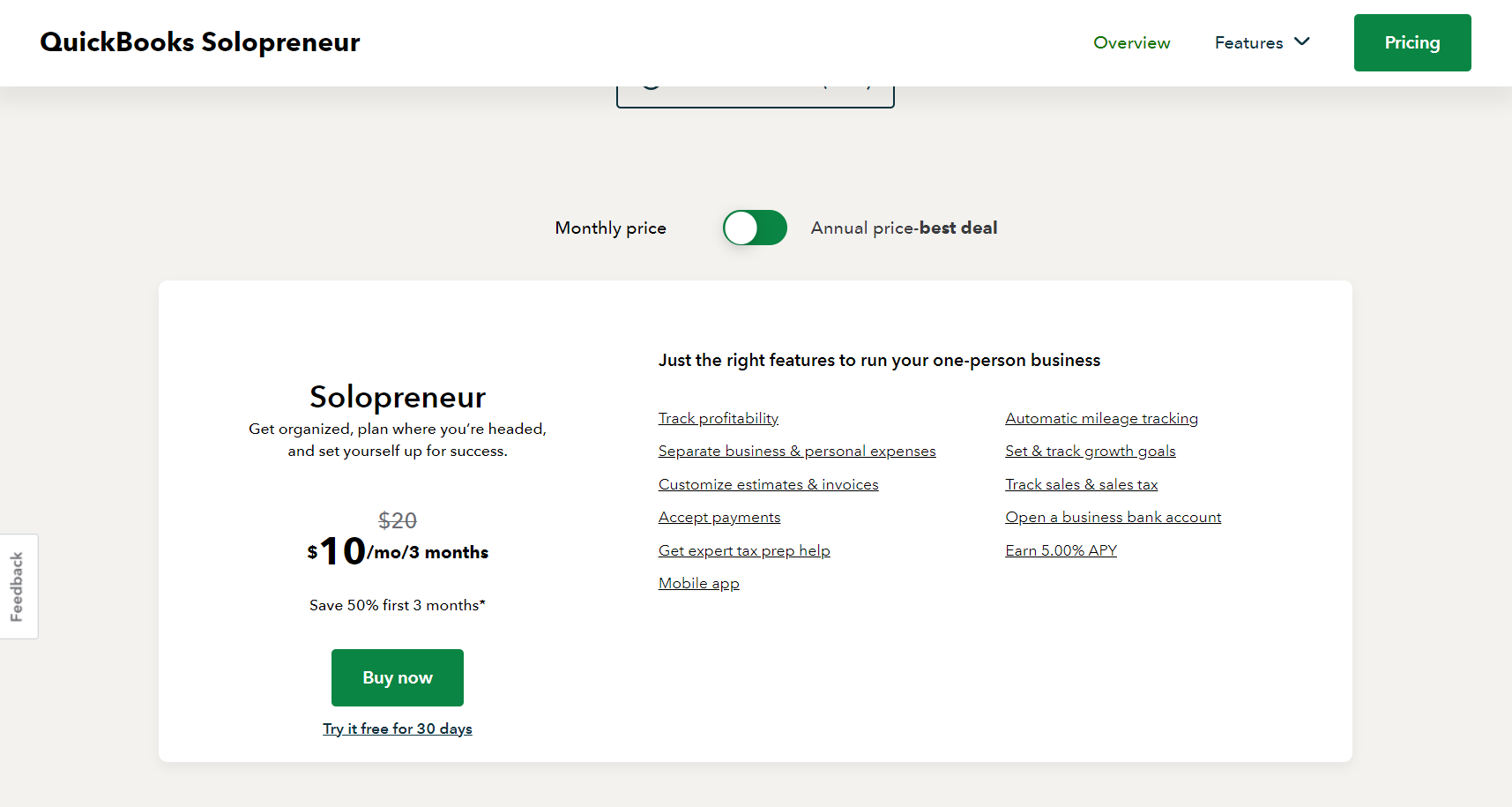

QuickBooks Solopreneur

Price: $20 per month

Features:

- Automatic Mileage Tracking

- Separate Business and Personal Expenses

- Growth Goal Tracking

- Customizable Estimates and Invoices

- Sales and Sales Tax Tracking

- 00% APY

- Expert Tax Assistance

QuickBooks Money

Price: $0 per month

Features:

- 00% APY

- Business Bank Account

- Invoices

- Instant Deposits

- Money Transaction History

QuickBooks Simple Start

Price: $30 per month

Features:

- General Reports

- Automatic Mileage Tracking

- Income and Expenses

- Growth Goal Tracking

- Estimates and Invoices

- Sales and Sales Tax Tracking

- Expert Tax Assistance

You can try QuickBooks Solopreneur free for 30 days.

5. QuickBooks Self-Employed Review: Where QuickBooks Self-Employed Stands Out

- Simplified Bookkeeping

QuickBooks Self-Employed streamlines your bookkeeping tasks, making it easy for you to track your income and expenses. It automatically categorizes transactions, saving you time.

2. Mileage Tracking

QuickBooks Self-Employed offers automatic mileage tracking, crucial for self-employed professionals who frequently drive for work. It helps you accurately deduct business-related mileage on your taxes.

3. Separation of Business and Personal Expenses

QuickBooks Self-Employed allows you to keep personal and business finances separate. You can link your bank accounts and credit cards to track business-related transactions separately.

4. Invoicing and Estimates

Create professional invoices and estimates directly with QuickBooks Self-Employed. Customize each one with your branding and send to clients effortlessly.

5. Tax Deductions

QuickBooks Self-Employed helps you identify potential tax deductions based on your business expenses, ensuring you don’t miss out on any eligible deductions.

6. Quarterly Estimated Taxes

QuickBooks Self-Employed calculates your estimated quarterly taxes, helping you stay on top of your tax obligations.

6. QuickBooks Self-Employed Review: Where QuickBooks Self-Employed Falls Short

- Limited Features

QuickBooks Self-Employed helps you with basic bookkeeping and tax management. It lacks advanced features which you can find in more robust accounting software.

2. No Double-Entry Accounting

Unlike comprehensive accounting software, QuickBooks Self-Employed lacks the support of double-entry accounting. If you need to track complex transactions, you find this limitation restrictive.

3. No Payroll Management

QuickBooks Self-Employed doesn’t handle payroll processing. If you have employees or contractors, you need a separate solution for payroll.

4. Limited Reporting

QuickBooks Self-Employed provides your basic reports but lacks the capability to customize your reports. You can find this in other accounting tools.

5. Scalability

QuickBooks Self-Employed is suitable mainly for sole proprietors and freelancers. If your business grows significantly, you outgrow its capabilities.

>>> GET SMARTER: SliQ Invoicing Software Review

7. QuickBooks Self-Employed Review: How to Start Using QuickBooks Self-Employed

To sign up for QuickBooks Self-Employed, follow these steps:

- Open an account with Intuit

- Follow the link – Intuit Accounts – Sign In

- Enter your Intuit email address or phone number.

- Click on Sign In

Then, you are ready to start using QuickBooks Self-Employed

8. QuickBooks Self-Employed Review: Alternatives to QuickBooks Self-Employed

Xero

Xero is a versatile accounting software suitable for your business, no matter its size, it works for businesses ranging from small startups to large enterprises. Xero offers robust accounting features, including invoicing, expense tracking, and bank reconciliation. It integrates seamlessly with other apps and services and supports multi-currency transactions for international business. Additionally, Xero provides collaborative tools for accountants and business owners to work together efficiently. Xero has a user-friendly interface and intuitive navigation, making it accessible to you irrespective of your knowledge of accounting.

Quicken Home & Business

Quicken Home & Business is primarily for your personal finance management, catering to your budgeting, investment tracking, and rental property management. Quicken allows you to track your finances, including income, expenses, and investments. It also offers you rental property management tools and integration with financial institutions for automatic transaction syncing. Quicken is a popular choice among personal finance enthusiasts for its comprehensive features and ease of use.

FreshBooks

FreshBooks is especially for you as a freelancer or a self-employed professional. FreshBooks includes features such as invoicing, expense tracking, time management, and client communication. These tools are available to help you streamline your workflow and enhance your productivity as an independent worker. FreshBooks receives praise for its user-friendly interface and straightforward navigation, making it easy for you to manage your finances efficiently.

Patriot Software – Accounting Premium Plan

Patriot Software’s Accounting Premium Plan simplifies your payroll processes, making it ideal for your business if you require a comprehensive payroll management system. It offers accounting tools such as expense tracking and financial reporting, alongside payroll processing and tax compliance. Patriot Software also includes time-saving automation features to enhance your efficiency.

Wave Accounting

Wave offers you a free accounting solution, making it an attractive option for your small business even though you are on a budget. Wave provides essential accounting tools, including expense tracking, invoicing, and receipt scanning. It also offers basic financial reports and integrates with a variety of payment processors. Wave has a straightforward setup and offers ease of use, making it accessible for your small business.

Zoho Books

Zoho Books is accessible via mobile devices, providing convenience for your business on the go. Zoho Books includes invoicing, expense management, and bank reconciliation. It also offers collaboration tools for teams and integrates with other Zoho apps. Zoho Books has competitive pricing, offering an affordable solution for your business if you are looking for a comprehensive accounting tool.

9. QuickBooks Self-Employed Review: Customer Reviews

QuickBooks Self-Employed receives positive reviews on TrustRadius, with an overall score of 9.2 out of 10 based on 54 reviews. Users appreciate its ease of use, particularly freelancers and independent contractors. It helps organize business expenses and income, reducing the hassle of paper receipts.

It receives high praise for features like automatic mileage tracking and expense logging. Some users find it ideal for tracking profits and losses. However, it receives complaints about putting entries under the wrong categories and having to cross-check regularly to correct its errors.

Pro Tips

- Choose the Right Software

Identify Your Needs: Assess your business size and accounting needs. Choose the software that scales with your business.

Check Feature Set: Ensure it has essential features like invoicing, expense tracking, and tax management.

2. Set Up Properly

Chart of Accounts: Set up a comprehensive chart of accounts to categorize your transactions accurately.

Bank Integration: Connect your bank accounts to automate transaction imports and reconciliations.

3. Regular Updates

Daily Entries: Enter transactions regularly to keep your books current.

Reconcile Monthly: Reconcile your bank statements and accounts monthly to catch errors early.

4. Automate Where Possible

Recurring Invoices: Set up recurring invoices for your regular clients to save time.

Auto-Categorization: Use auto-categorization for your regular expenses and income.

5. Utilize Reporting Tools

Custom Reports: Customize your reports to gain insights into specific areas of your business.

Regular Reviews: Schedule your regular financial reviews to monitor cash flow, profits, and expenses.

6. Leverage Integrations

Business Apps: Integrate with other business apps like payment processors, CRM, and project management tools.

Tax Software: Use integrations with tax software for seamless tax filing.

7. Stay Organized

Separate Accounts: Keep your business and personal finances separate to avoid complications.

Digital Receipts: Store digital copies of your receipts and documents for easy access and compliance.

8. Understand Your Metrics

Key Metrics: Track key performance metrics like cash flow, profit margins, and expense ratios.

Benchmarking: Compare your metrics against industry benchmarks to gauge performance.

9. Train Your Team

Training Sessions: Provide training for your employees who use the software.

10. User Permissions: Set appropriate user permissions to control access and maintain security.

11. Backup Data

Regular Backups: Ensure regular backups of your accounting data to prevent loss.

Cloud Storage: Use cloud storage solutions for secure, off-site data backup.

12. Review and Adjust

Audit Trail: Regularly review the audit trail to ensure you record all transactions accurately.

Adjust Entries: Make adjusting entries for any discrepancies you identify during reviews.

13. Stay Compliant

Tax Regulations: Stay current on tax regulations and ensure your software is compliant.

Audit Preparation: Keep your records organized to facilitate smooth audits.

14. Seek Professional Help

Accountant Support: Collaborate with an accountant for complex issues or year-end closings.

Tax Expert Advice: Utilize professional tax personnel support if available, especially for tax planning and filing.

Recap

QuickBooks Self-Employed is an ideal accounting tool for you if you run your business alone as a freelancer, entrepreneur, or sole proprietor due to its user-friendly interface, automatic mileage tracking, and expense categorization for Schedule C. It offers affordable custom bookkeeping support and quarterly tax estimates.

However, it lacks advanced features like double-entry accounting and is not suitable for rapidly growing businesses. While it simplifies your bookkeeping and tax management, it does not support your payroll or complex reporting needs. Alternatives like Xero, FreshBooks, and Wave are better for you if you require more robust features. User reviews highlight ease of use and valuable tax-related features, despite some limitations.